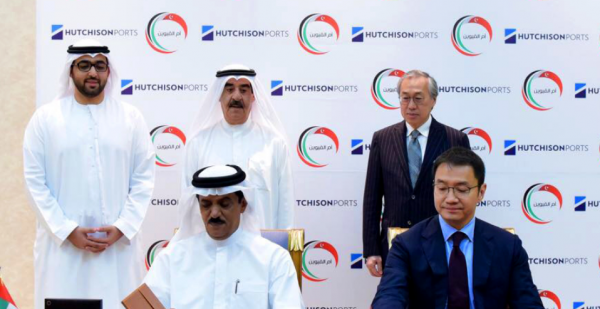

Hong Kong-based port operator, Hutchison Ports, announced that it was awarded a concession to operate the Ahmed Bin Rashid Port in Umm Al Quwain, a key entry-exit point for container, general, Ro-Ro and bulk cargo in the northern UAE.

Hutchison Ports will run the four-berth facility with an 845-metre-long quay and a 23-hectare yard, which will be under the name of Hutchison Ports UAQ, the port operator said in a statement.

The financial details for this agreement were not disclosed.

Andy Tsoi, Managing Director of Middle East and Africa, stated: “The UAE economy is growing strongly and there is great demand for terminal facilities in the northern part of the Emirates. Our target is to improve the service level of the port to facilitate the emirate’s import and export trade. We look forward to contributing to the growth of the local economy.”

From his part, Mr. Sultan Saeed Al Ali, Executive Director, Umm al Quwain Ports, Customs & Free Zone Corporation believes that this agreement will help the port in Umm Al Quwain to serve better the local community as well as the existing companies by attracting future investment.